Condo Insurance in and around Atlanta

Townhome owners of Atlanta, State Farm has you covered.

Condo insurance that helps you check all the boxes

There’s No Place Like Home

With the variety of condo insurance options to choose from, you may be feeling overwhelmed. That's why we made choosing State Farm straightforward. As one of the top providers of condominium unitowners insurance, you can enjoy impressive service and coverage that is competitively priced. And this is not only for your condo unit but also for your personal belongings inside, including things like tools, clothing and electronics.

Townhome owners of Atlanta, State Farm has you covered.

Condo insurance that helps you check all the boxes

State Farm Can Insure Your Condominium, Too

Everyone knows having condominium unitowners insurance is essential in case of a hailstorm, blizzard or fire. The right amount of condo unitowners insurance lets you know that you condo can be rebuilt, so you aren’t stuck making payments for a home you can’t live in. An additional feature of condo unitowners insurance is that it also covers you in certain legal cases. If someone trips at your residence, you could be held responsible for physical therapy or their hospital bills. With enough condo coverage, you have liability protection in the event of a covered claim.

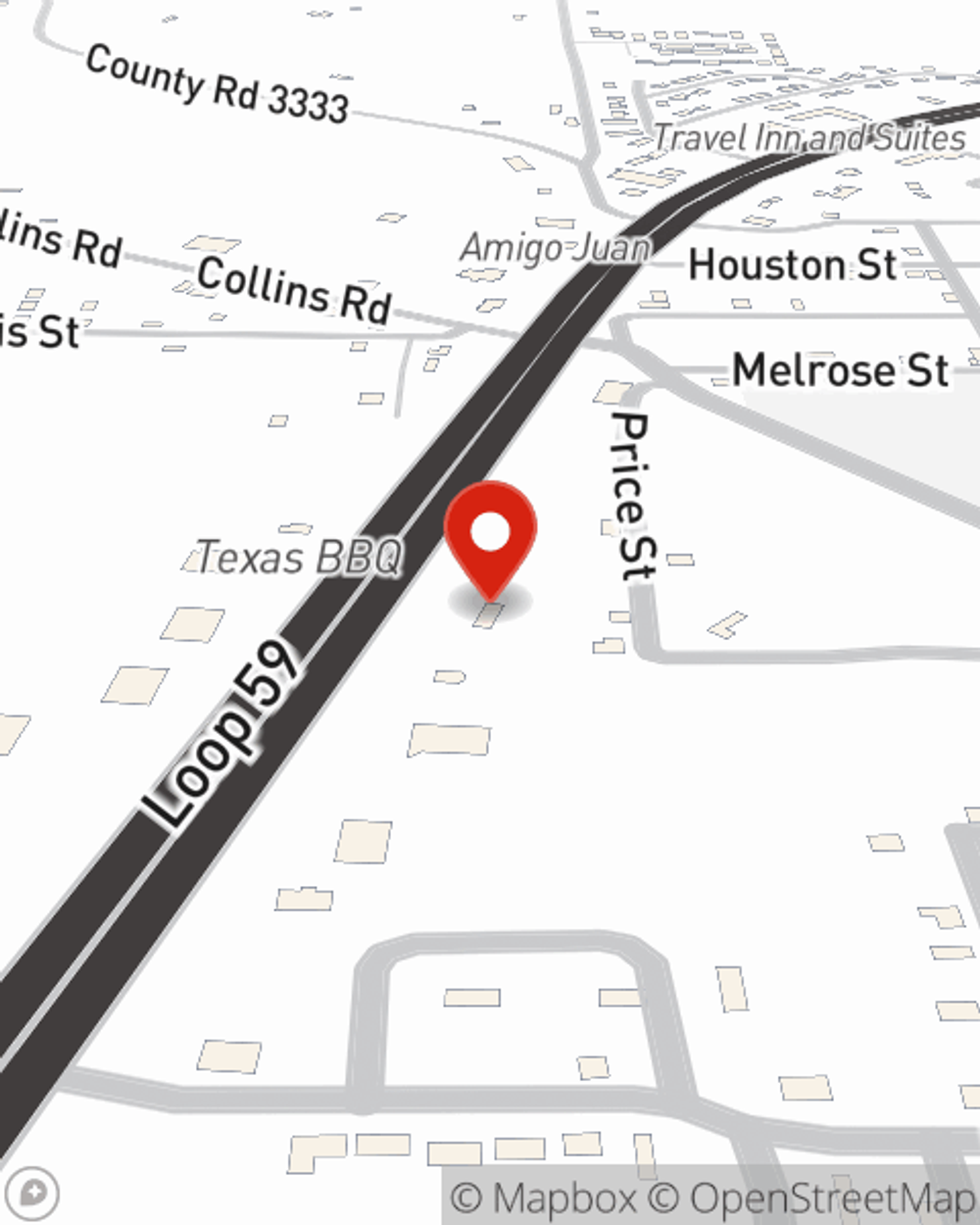

Intrigued? Agent Kelli Ashbrook-Cummings can help walk you through your options so you can choose the right level of coverage. Simply call or email today to get started!

Have More Questions About Condo Unitowners Insurance?

Call Kelli at (903) 796-8100 or visit our FAQ page.

Simple Insights®

Help protect yourself from contractor fraud

Help protect yourself from contractor fraud

Shady contractors and home repair scams can cost you. Discover tips to help protect yourself from repair scams and learn how to spot home repair fraud.

Help protect your home against common causes of house fires

Help protect your home against common causes of house fires

Devastating home fires are an unfortunate reality. Learn about the causes of house fires and precautions to help prevent a fire before it starts.

Kelli Ashbrook-Cummings

State Farm® Insurance AgentSimple Insights®

Help protect yourself from contractor fraud

Help protect yourself from contractor fraud

Shady contractors and home repair scams can cost you. Discover tips to help protect yourself from repair scams and learn how to spot home repair fraud.

Help protect your home against common causes of house fires

Help protect your home against common causes of house fires

Devastating home fires are an unfortunate reality. Learn about the causes of house fires and precautions to help prevent a fire before it starts.